Financial ServicesPlatform & Products

The hidden chaos of financial systems integration & implementation

Weak financial systems integration slows growth in markets where speed and confidence matter most. Integration chaos…

Read article

05/30/2024

by Meher Vallabhaneni

From personalized banking and fraud detection to algorithmic trading and risk management, Artificial Intelligence (AI) has emerged as a pivotal force that is reshaping paradigms and driving transformative change across every facet of the financial services industry. However, with immense potential comes equal risk, and AI raises several concerns around data privacy, algorithmic bias, regulatory compliance, and the implications of automated decision-making, amongst others. All-in-all, AI stands out both as a beacon of promise and a harbinger of uncertainty in the ever-changing landscape of the financial services industry, and as more financial institutions embrace AI technologies to streamline operations, enhance customer experiences, and drive profits, the stakes have never been higher.

Navigating this arena requires a keen understanding of both the opportunities and threats that AI presents, and by proactively addressing them, financial institutions can not only mitigate potential risks but also unlock new opportunities to gain a competitive edge.

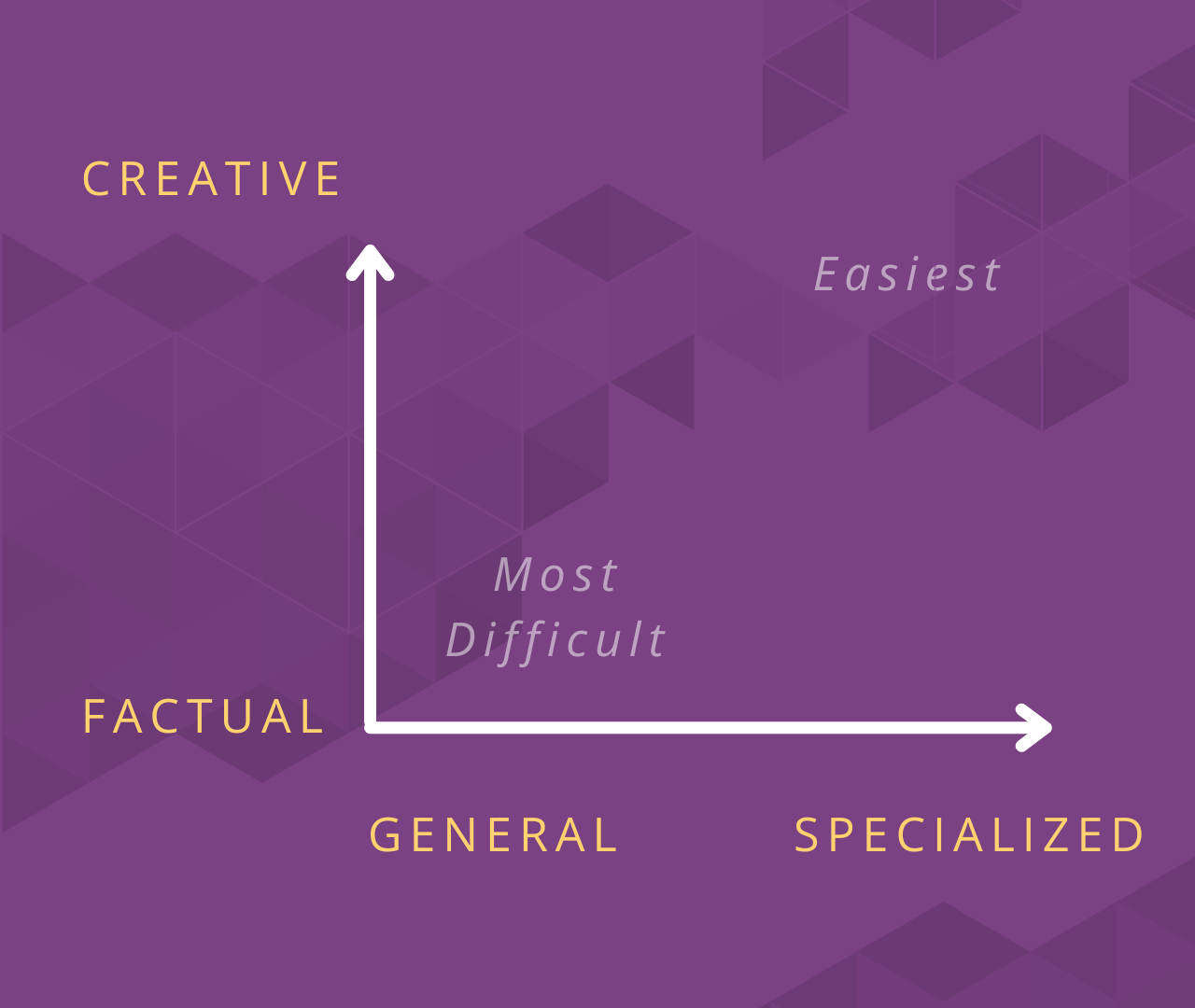

In the pursuit of AI-driven transformation, one common pitfall many organizations find themselves falling into is casting their nets into the wrong waters – investing resources into activities and products that yield diminishing returns. Activities such as automating routine tasks and optimizing existing processes can be alluring and often serve as strong use cases for predictive analytics. However, AI has a different value proposition: its ability to unlock specialized and creative capabilities that drive innovation and competitive advantage.

Looking at the realm of customer engagement and personalization for example, while it may be tempting to deploy generic AI algorithms to deliver marketing messages or cookie-cutter products quickly, the real excitement happens when AI is harnessed to understand individual preferences, anticipate needs, and craft custom-made experiences that resonate on a personal level with each customer. By investing in tools that prioritize specialization and creativity, organizations can forge deeper connections with these customers, foster brand loyalty, and ultimately drive bottom-line growth.

Likewise, in the risk management and compliance sectors, AI has the potential to transform how organizations identify and mitigate threats. Many organizations pursue one-size-fits-all solutions that fail to account for the delicate and ever-evolving nature of risk, but by using AI to develop bespoke risk models, scenario analyses, and predictive analytics tailored to specific business scenarios, organizations can preemptively identify emerging risks, seize opportunities, and stay ahead of the curve in an increasingly volatile landscape.

The specialized and creative space for AI also extends beyond traditional banking and finance, but realizing the full potential in this space requires a willingness to experiment and take calculated risks. It also requires organizations to cultivate a culture of innovation, and leaders to champion bold ideas, empower cross-functional teams, and foster collaboration. By venturing into these uncharted territories, organizations can unlock new revenue streams, differentiate themselves, and be positioned as trailblazers, turning threats into opportunities and paving the way for sustainable growth.

Amidst all the promise and progress with AI, there also lurks the bad actors who harness AI for malignant purposes, especially to commit financial fraud. The exponential growth of AI capabilities also empowers the ability to exploit vulnerabilities in systems, execute advanced attacks, and perpetrate fraud at an unprecedented speed and scale.

The sheer velocity at which AI-enabled fraud can occur is one of the most alarming aspects. As traditional fraud detection systems are often reliant on static rules and manual review processes, bad actors leverage AI algorithms to dynamically and rapidly adapt techniques to evade detection and undermine security deficiencies, making it increasingly difficult for financial institutions to stay ahead.

Paired with the scale of AI fraud, which can span across companies, industries, and geographies, organizations can be left dealing with staggering problems. From phishing scams and identity theft to market manipulation and money laundering, the same AI that can help manage large volumes of customers can be used to orchestrate large scale attacks on individuals, businesses, and entire financial systems. The interconnected nature of global markets along with the increase of digital transactions also provides a foundation for these hostile activities to thrive, amplifying the impact and magnitude of financial fraud.

Furthermore, the increase in availability of AI tools and technologies has lowered the barriers to entry for bad actors, enabling even amateur hackers to launch attacks with off-the-shelf AI algorithms, further augmenting the challenge for financial institutions.

Addressing this threat of AI-driven financial fraud requires multi-faceted approaches that combine innovation, oversight, and collaboration. Financial institutions need to invest in advanced fraud detection and prevention systems that themselves leverage AI and machine learning, especially ones that are specialized and creative, as many fraud solutions often look to exploit the generic security products. These prevention and detection systems in turn can be used to detect atypical patterns, identify emerging threats, and respond in real time. Enhanced AI authentication tools can also add an extra layer of security to prevent fraud as well.

Trust is key to the financial services sector, and safeguarding the integrity of financial systems is paramount to preserving customer confidence in an increasingly digital economy.

As financial service organizations continue to think through the adoption of AI, they are faced with a myriad of other challenges and pivotal decisions, along with those mentioned above, that can shape the ultimate success of their AI initiatives. From understanding the complexities of AI performance and scalability to identifying the most impactful use cases to creating thorough implementation plans, thinking through all these aspects is critical to achieving the desired results.

First, ensuring optimal performance and scalability across diverse use cases and workloads is key. Financial institutions operate in environments where speed, accuracy, and reliability are essential, and AI algorithms must deliver real-time insights, manage massive volumes of data, and adapt to constantly changing market conditions. Achieving this requires careful consideration and selection of AI models, tools, and applications; optimization of resources; and continuous monitoring to ensure efficiency and effectiveness. Along with that, while AI offers many opportunities, not all use cases are equal, and financial institutions must evaluate the ROI, feasibility, and scalability of AI projects to prioritize the ones with the greatest potential.

Additionally, the complexity of AI systems often present several obstacles for financial organizations, many of which grapple with legacy infrastructure, siloed data, and disparate systems. Integrating AI into existing processes and procedures requires a holistic approach to address technical, organizational, and cultural barriers, requiring comprehensive strategies to navigate transformation involving modernization and change management efforts.

Lastly, having a comprehensive implementation plan with clear roadmaps, defined milestones, and alignment with business goals and regulatory requirements is crucial. Governance frameworks to manage the project, mitigate risks, and ensure compliance are also critical to ensure appropriate collaboration between cross-functional teams and foster growth, innovation, and accountability.

With AI, the possibilities can be limitless, both in terms of threats and opportunities. However, with great risk comes great rewards, and with AI those rewards can be boundless. If you are facing challenges prioritizing the many efforts required to implement an effective AI solution or would like to learn more about our work in this area, please use the “Drop Us A Line” form at the bottom of this page to connect.

Business insights

Financial ServicesPlatform & Products

Weak financial systems integration slows growth in markets where speed and confidence matter most. Integration chaos…

Read article

Financial ServicesAI

Hyper-personalization is becoming a critical differentiator in financial services. AI and broader digital…

Read article

Financial ServicesAI

In the rush toward the next AI frontier, it’s easy to treat every challenge as if it needs autonomy. Here’s a…

Read article