Financial ServicesAI

The technical and operational path to agentic AI in financial services

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial Services Platform & Products

12/01/2022

by Chad Perkins

“Change.”

Depending on the context and audience, this word can stir excitement or anxiety.

Regardless of the emotional response, change is, at some point, a must for everyone. While it’s comfortable to lean on familiar processes, entrenched technology solutions, and combinations of disconnected systems; your employees, customers, and competitors will ultimately demand something different. At the risk of sounding dramatic, for the innovative financial services provider, if you’re not adapting, you’re dying.

New process and technology implementations are a question of when, not if. So, how can you prepare to ensure financial innovation begins with the proper foundation? Many of us have experienced a project that goes long and wrong. This isn’t necessarily because of a bad idea or because the innovation was unimportant. These long and wrong projects are often because the foundation for success was stepped over in the excitement to begin. How can you be sure that you’re properly planning for future success? Let’s look at some key perspectives and a few recommendations that will lend towards a win-win-win experience:

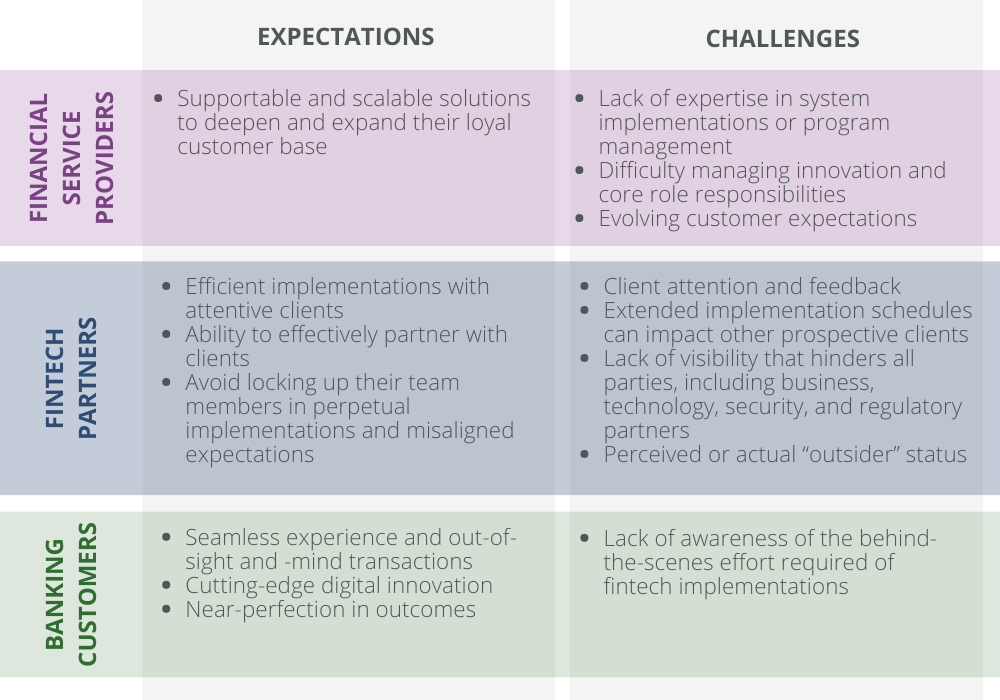

If “adapt or die” is the why behind financial innovations, who are the impacted parties and what are their expectations?

After assessing the expectations and challenges of implementations, how do you prepare to draw these unique wants and needs together to foster a win-win-win scenario?

Laying the groundwork for a successful implementation, although less exciting than seeing immediate delivery take place, will pay dividends as the innovation unfolds:

1. Define ownership: Assign the point person tasked with the execution.

What’s a team without a coach, ingredients without a chef, an orchestra without a director, or a building without an architect? Clearly define program leadership whose primary focus is navigating a successful implementation. This person should be empowered to make day-to-day decisions, avoid management by committee, and know what needs to be escalated to the steering committee level. They should be versed in implementation and vendor management best practices, able to speak the “languages,” and understand the needs of both banking business stakeholders and fintech partners.

2. Build the right team: Define the core supporting players where all required groups have a seat at the table.

Each leader needs to be empowered to preemptively identify and fill their teams so that they can orchestrate the right activities at the right times. Unfilled roles introduce the risk of bandwidth constraints, inefficiencies of additional ramp-up time, and missed requirements, to name a few. In addition to program leadership, plan through the right-sized (see; realistic) needs of business analysts, change champions, testers, vendor partners, technology leaders, legal experts, cybersecurity personnel, regulatory advisors, and business stakeholders.

3. Define expectations: Set the goal and obtain team buy-in for what success looks like.

Each team needs to know what success looks like so they can move together toward the same goal. In the beginning of a project, there are going to be some open questions. It’s important to be tactful in the way your team accepts and tackles unknowns. Start by managing expectations on when it’s acceptable to move forward with a plan and developing a process to handle unknowns.

Everyone wants a “quick” program, but it’s important for your vendor partners to adequately understand your unique complexities and constraints, and therefore more clearly understand the true level of effort and realistic timeline. Use your program leadership to intentionally set expectations with the implementation or technology partners and, when appropriate, bring them into the planning sessions.

Prioritizing due diligence, ensuring expectations and challenges are taken into account, and demonstrating teamwork increases your chance of success in both metrics–including time, money, capabilities, offerings–and experience–for your employees, customers, and vendors.

Here are some of the ways these early investments of time and resources are beneficial:

Financial Services Providers

Fintech Partners

Banking Customers

Adaption is never one-size-fits-all and rarely can be summed up with one playbook. The right combination of ground-floor leadership, expectations alignment, due diligence, and planning will serve as the pillars of a win-win-win implementation for the innovative financial services providers, fintech partners, and banking customers.

Learn more about our Optimize Technology solution to see what this path of innovation can look like with us.

Business insights

Financial ServicesAI

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial ServicesPlatform & Products

Weak financial systems integration slows growth in markets where speed and confidence matter most. Integration chaos…

Read article

Financial ServicesAI

Hyper-personalization is becoming a critical differentiator in financial services. AI and broader digital…

Read article