Financial ServicesAI

The technical and operational path to agentic AI in financial services

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial Services Customer Journey

06/06/2024

by Alex Hill

In today’s rapidly evolving financial services landscape, there has been a seismic shift in the way traditional institutions approach competition. Smart, savvy fintech competitors, along with the global digitization wave, have transformed customer expectations. With cybercrime on the rise and stringent regulatory compliance measures, banks face unique pressures from every angle. Yet, amidst this complexity, one thing remains clear: consumers demand more from their financial institutions. They want a partner who can securely manage their finances, understand their goals and preferences, and proactively deliver tailored offers and services to enhance their financial well-being. This personalized engagement is no longer a luxury but essential in differentiating banks from both traditional competitors and agile fintech startups.

Prioritizing the CX journey is no longer a novelty but a necessity. Keep reading to learn more about the role of CX tools in revenue-positive relationships with customers and strategies for selecting the right technology to achieve strategic goals.

The shift toward a customer-first approach isn’t just a trend; it’s a fundamental business imperative. Research indicates that 80% of customers now expect personalized services from their financial institutions, regardless of their wealth status. This statistic underscores the fact that personalization in banking has evolved from being a novelty to a necessity. While most organizations have some digital presence offering basic day-to-day support, customers are looking for a GPS roadmap to navigate and strengthen their financial well-being, not just a rear-view mirror view of past transactions. A study from The Financial Brand reveals that 1 in 5 customers is willing to pay more or share more personal information with their banking provider, in exchange for a better understanding of and support in achieving their financial goals.

Despite this willingness on the customer side, banks often fall short in utilizing available data. According to recent surveys, only a fraction (less than 17% in some studies) of financial institutions are advanced in providing contextual personalized insights and solutions to consumers, leaving plenty of room for banks to stay ahead of the competitive curve as digital pioneers. To summarize, with advanced analytics tools now accessible to virtually any organization, there’s a unique opportunity for banks to leverage customer data ethically and effectively to enhance the CX journey.

Central to delivering a luxury or personalized banking experience is the use of advanced CX tools and technology. CX software solutions are designed to optimize, monitor, and enhance the overall customer journey, providing banks with valuable insights into client behavior and preferences. From CRM systems to AI-powered analytics platforms, these tools empower institutions to deliver personalized experiences at scale. For instance, chatbots, digital-only banks, and AI-assisted self-service tools are revolutionizing customer interactions. Yet, a study by Gartner highlights that while 70% of customer interactions are expected to involve emerging tech, the financial services industry lags in implementing AI at scale. Why should this data matter to banks? Because a strong CX strategy presents a prime opportunity to combine customer experience and digital innovation into one plan, enhancing their competitive edge.

There’s a business case for building a strong, consistent, omnichannel banking experience. Recent studies show that 63% of customers will pay for a better experience and that this change in focus has the potential to increase revenue by an average of 23%.

Here are two strategies to incorporate emerging CX Solutions in your banking strategy:

1) Use data and analytics to create empowered customer journeys.

2) Use real-time customer insights to offer an empathetic, personalized, and contextual customer experience.

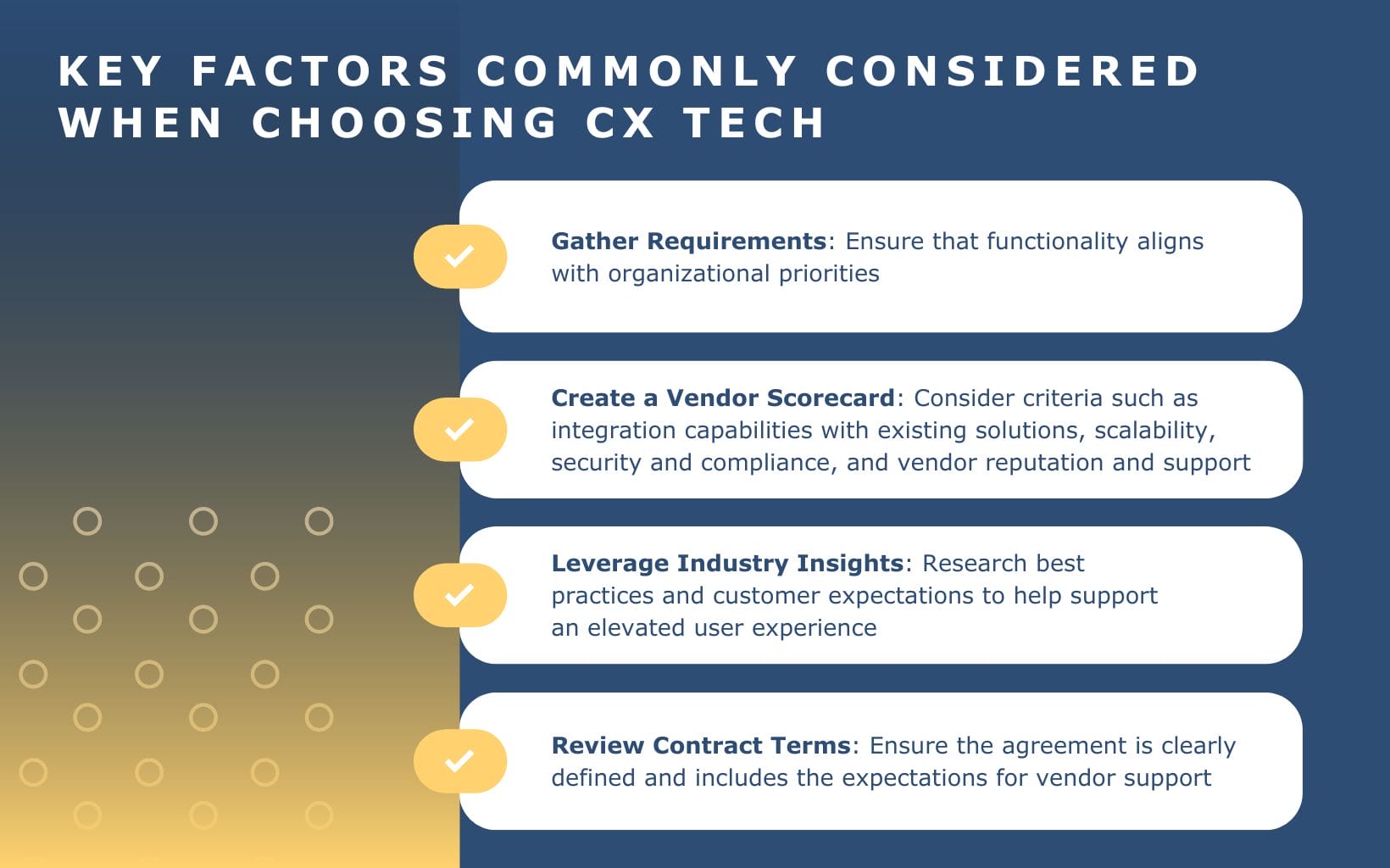

When selecting software and technology solutions, take a systematic and thorough approach. Start by defining your organization’s specific needs and objectives, considering factors such as scalability, regulatory compliance, and budget constraints. Once the requirements are defined, conduct research to identify potential vendors and solutions; request demonstrations and pilot tests to assess performance and user experience; leverage customer insights from trusted resources in the evaluation process to ensure their needs are addressed; and, finally, review contract terms and pricing structures to ensure transparency.

So, what next? Prioritizing a customer-first approach is essential for banks to thrive in today’s competitive landscape. By leveraging personalized CX tools and technology, banks can deliver the level of service that today’s clients expect, driving satisfaction, loyalty, and ultimately, business success.

If you’re ready to elevate your banking experience and prioritize your customers, follow these best practices for selecting the right technology solutions. Your clients will thank you, and your bottom line will reflect the investment.

Business insights

Financial ServicesAI

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial ServicesPlatform & Products

Weak financial systems integration slows growth in markets where speed and confidence matter most. Integration chaos…

Read article

Financial ServicesAI

Hyper-personalization is becoming a critical differentiator in financial services. AI and broader digital…

Read article