Financial ServicesAI

The technical and operational path to agentic AI in financial services

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial Services Assessment & Optimization

08/02/2022

by Tom Cartwright

The Financial Services industry was one of the first sectors of the economy to enthusiastically embrace the promise of big data, analytics, and digitalization. Nearly all players initially welcomed the efficiencies and savings of advances like ATMs and direct deposit. Today, disruptive innovation in financial services is reshaping the industry and changing the fundamental rules for how to attract, secure, and serve customers.

The true automation of banking began decades ago with Electronic Fund Transfers. Today, digitalization continues to reshape not only how payments are made but who oversees and administers them. Lean and mean tech start-ups and buy now, pay later solutions abound; but trusted brands with deep pockets – including Apple Pay and Amazon Pay – are claiming their share of the market by attracting customers and merchants with their ease of use and lower fees.

Current projections suggest over half of the U.S. population may take on some form of gig work in the next decade. While some argue the gig worker is underserved by financial institutions, the truth is these workers present challenges in areas like credit decisioning and income verification that the industry has not yet solved. Financial institutions that leverage data and analytics to determine new models for assessing gig worker risk will reap significant rewards. Digital approaches will most likely prevail with ease of use, lower cost, and highly personalized services that meet gig workers’ needs and manage risk for the financial institution.

Regulations initially designed to manage risk in the financial services sector continue to change. Financial institutions that traditionally operated in defined geographic markets and catered to the demands of local market segments now have access to a broader customer base. This influx of market competition is transforming once passive consumers into sophisticated buyers. Additionally, recent deregulation has loosened the capital requirements on small to medium financial institutions put in place by Dodd Frank; the changes have resulted in increased liquidity, freeing up funds for financial institutions to lend and invest.

Fintech was once defined as any technology used for back end systems required by financial institutions to manage operations and processes. Over time, fintech has shifted to include personal and business oriented financial services that customers can access on their desktop or mobile device. Up until now, traditional institutions offered a variety of services under a single umbrella including savings, checking, planning, and investment trading. In its most basic form, fintech unbundles these services into individual offerings. The combination of a la carte offerings with technology enables fintech companies to be more cost efficient. In summary, fintech companies are challenging traditional financial services companies.

Together, these four emerging forces are driving industry-wide changes that cannot be ignored. Simply put, today’s financial institutions aren’t just competing against each other; they’re competing against emerging technologies that demand new ways of doing business.

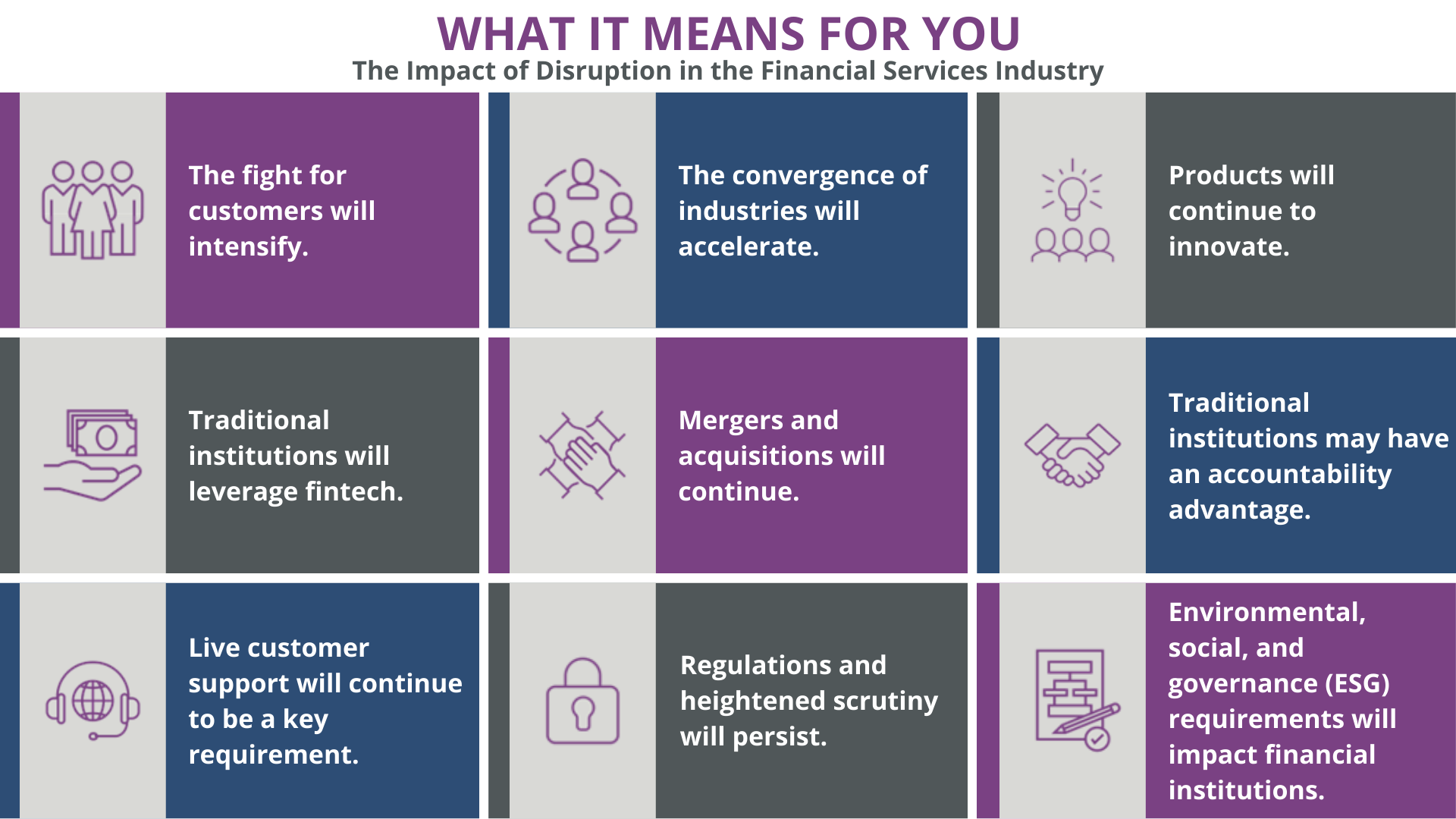

The future is rapidly changing, but a few conclusions can be drawn:

The fight for customers will intensify. Expect fierce competition from new players and niche solutions that target specific market segments such as high net worth, gig workers, high-risk consumers, and underserved clients.

The convergence of industries will accelerate. Big tech, fintech, and other players continue to move into financial services and products.

Products will continue to innovate. The success of new products available online or at the point of sale is determined by their ease of use and access. The financial services ecosystem will continue to adapt.

Traditional institutions will leverage fintech. Fintech firms like Sharegain and TradeStation, for example, enable banks and wealth managers to offer securities lending and other sophisticated services. Financial services firms will partner with fintech to tap new markets and services for their customers.

Mergers and acquisitions will continue. Community and regional firms who do not have the resources, infrastructure, or technical acumen to keep up will seek consolidation or acquisition.

Traditional institutions may have an accountability advantage. Consumers may seek out the customer experience and accountability offered by traditional firms. This is especially true with recent examples, such as the anonymity of cryptocurrencies or the chaos of “meme stock” trading on Robinhood.

Live customer support will continue to be a key requirement. In this critical area, new players may find themselves trying to catch up with traditional financial institutions. Customer support will become an important differentiator as tech-enabled services become more standard and commoditized.

Regulations and heightened scrutiny will persist. This is especially true with new business models from big tech, fintech, and other players dealing in new forms of services such as crypto and buy now, pay later.

Environmental, social, and governance (ESG) requirements will impact financial institutions. Definitive changes will influence investment decisions, lending practices, labor policies, and more. With heightened attention to ESG concerns, the need for financial institutions to act will continue to increase.

Digital payment systems, changing economic structures, deregulation, and emerging fintech are all creating disruption in the financial services industry. Customer demand and industry competition continue to impact the ways we approach business, while access to talent and resources introduces a new layer of complexity. With guidance from Sendero, your company can determine the best path towards optimizing competitive advantages and embracing new technologies crucial to success.

Are you ready to start the conversation? Fill out the form below to connect with one of our consultants.

Business insights

Financial ServicesAI

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial ServicesPlatform & Products

Weak financial systems integration slows growth in markets where speed and confidence matter most. Integration chaos…

Read article

Financial ServicesAI

Hyper-personalization is becoming a critical differentiator in financial services. AI and broader digital…

Read article