Financial ServicesAI

The technical and operational path to agentic AI in financial services

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial Services Cost Optimization

11/16/2023

by Wayne Tung, Kathryn Harrington, and George Hyde

So you’ve made the transition to cloud infrastructure, likely with more than one provider, and things are running as planned. Now, you’re starting to see increasingly higher invoices each month, and you don’t know why. The move to cloud was supposed to optimize your infrastructure and save you money, but you’re not seeing the expected savings benefits. What went wrong?

Yes, cloud can greatly increase operational efficiency and help you realize cost savings opportunities faster than traditional infrastructure. However, because cloud offers so many options, the pricing structures are complex, and discount opportunities are constantly evolving. This can make cloud cost optimization difficult to achieve.

It’s important to note that difficult doesn’t mean impossible. In fact, for most companies going through the journey to cloud, there is a great potential for savings on your cloud bill that you are likely unaware of. One of Sendero’s current clients achieved a 20% savings off their cloud spend within 1 year through the adoption of Cloud FinOps best practices.

At a base level, it is important to know that cloud does not bill at a flat rate per unit like with a traditional VM or server in a data center. Cloud charges are based on consumption, which may be a newer concept for your technical and leadership teams.

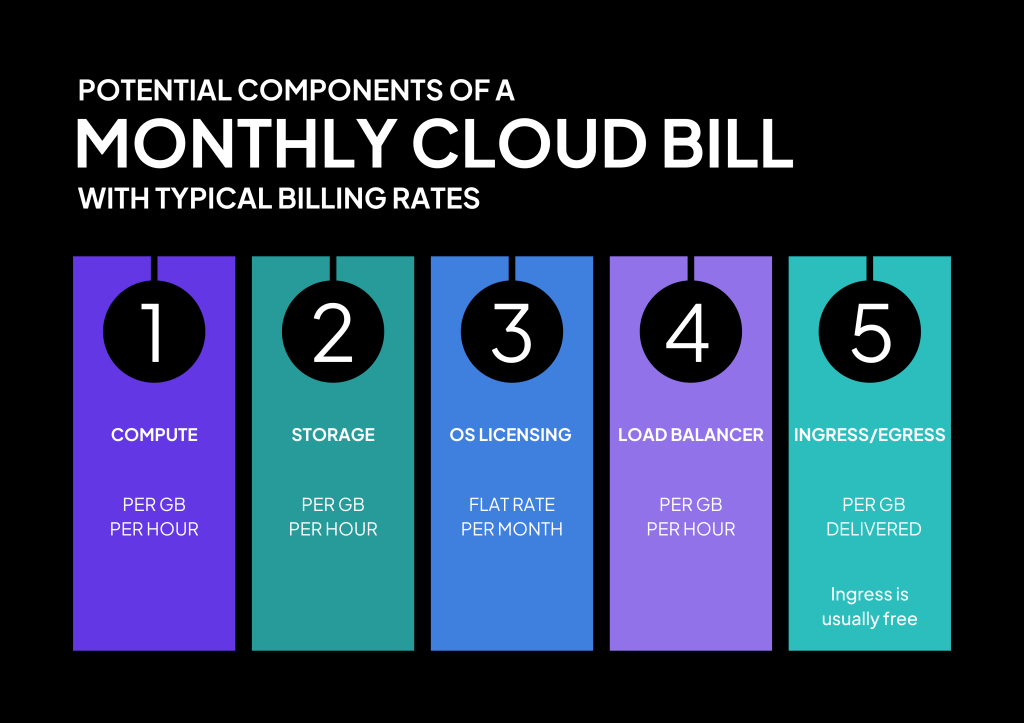

Here is an example of potential components that can make up the cost of one single machine on your cloud monthly bill:

In addition to each component or service type within cloud being billed differently, each provider has a unique pricing model and discount structure depending on your established contracts. Cloud providers will use different terminology as well which adds to the complexity.

Due to the complexity of cloud pricing and the growing offerings for cloud-native services, it is easy for teams to consume cloud resources without realizing the impact on cost. This is why cost transparency and established governance to optimize your cloud infrastructure are so important.

In order to achieve cost transparency and maximize your cloud spend, you will need to holistically understand your current cost drivers and usage as well as future plans for your cloud environment(s). This monitoring of monthly spend to create a culture of financial accountability is known as Cloud FinOps. FinOps is not a new concept, but the maturity and best practices of Cloud FinOps specifically are continuing to develop.

As you embark on the journey to integrate cloud into your operations and budgets, keep in mind the following questions: Am I optimizing based on the cloud services and discounts available to me? Do I know who is paying for each part of the bill and what is driving my costs?

If you’re not sure of the answers, it may be time for a Cloud FinOps audit. Fill out the form linked at the top of the page to connect with one of our consultants to see what this audit could look like for your organization.

Business insights

Financial ServicesAI

Unlocking Agentic AI’s true value requires a sturdy foundation and careful evaluation to avoid unintended consequences,…

Read article

Financial ServicesPlatform & Products

Weak financial systems integration slows growth in markets where speed and confidence matter most. Integration chaos…

Read article

Financial ServicesAI

Hyper-personalization is becoming a critical differentiator in financial services. AI and broader digital…

Read article